2019 Microsoft 70-347 Exam Dumps – 100% Success Guaranteed

How to pass Microsoft 70-347 Exam on First Try?

Do you know that recently Microsoft has updated the syllabus of its 70-347 Exam? Following those updates, Dumps4IT has also updated the material, just to offer you an immediate solution against your challenges which you might face in 70-347 Exam. The new syllabus of 70-347 Exam is intended to validate the skills to successfully manage the Office 365 tests. The Exam 70-347 validates your credentials against Certification Microsoft Web Designing. Our Exam material offers you latest exam questions and user-friendly interface to be certified associate in the first attempt.

Microsoft 70-347 exam is an equal opportunity provider, which help you in skill up-gradation and development. It is equally important for professionals, as well as for fresh candidates. No matter if you have hands on experience and a fresh candidate; you would have to study the recommended material of Microsoft. There is no alternate than to study the material, you can’t escape out of reading. But, if you are willing to lessen your chances of failure in the actual exam, then you must use the updated and latest questions of Exam Dumps.

Microsoft 70-347 Exam Questions: Now Available in 2 Formats

Our Exam material for Microsoft Certified Professional (70-347) exam has been prepared by the subject matter expert. You may now get the latest exam dumps from Dumps4IT in 2 easy-to-use formats; e.g. PDF and Practice exam. Both the formats are effective to help you and to make you pass exam on your first attempt. Dumps4IT offers you cost-effective study material, which can be shared with your peers. You will get one key on purchase of Microsoft exam material, which can be used on 2 Pcs.

70-347 PDF File:

The 70-347 Exam dumps are readily available in PDF formats, which is portable and can easily be installed and carried out anywhere. This is indeed a self-paced lower-cost and more reliable study material, which carries the actual questions; those will surely be questioned in the real exam.

70-347 Practice exam:

Our Practice exam offers you various self-learning and self-assessment features. So, all the knowledge you get from PDF file can be tested on our software. It offers you real exam simulation which helps you to learn and prepare for exam under actual environmental constraints, (exam settings, timed exams, and multiple mock test attempts, number of questions test report). Our Practice software is best suited to busy professional who doesn’t have enough time to spend on preparation. Its self-evaluating feature is good to identify your weak areas, which can be overcome by practicing same questions over again.

Try Free Demo of Microsoft 70-347 Practice Exam

Dumps4IT highly recommends the users to try the demo of product before purchase. This free demo will help you to get acquainted with the interface of software. Also, we give 24/7 customer support to our esteemed users. You may write us an email, in case you find any ambiguity in the product. Lastly, we give you 90 days free updates to all our users. If, in case, Microsoft introduces any changes within 90 days, our dedicated team will update the material. This update period will be effective right from the time of purchase.

Wednesday 24 April 2019

Monday 25 February 2019

Microsoft MCSA 70-347 Exam Dumps, 70-347 Practice Test Questions | RealExamDumps.com

Microsoft resurrected Kinect yesterday during the company’s HoloLens 2 press event at Mobile World Congress in Barcelona. The software giant has shrunk Kinect into a $399 PC peripheral that can be used as a sensor in similar ways to how developers used Kinect for Windows or even the original Xbox 360 Kinect. Microsoft has designed this new Kinect to be primarily used with Azure, the company’s cloud-based service, for computer vision and speech models.

I got a chance to get a closer look at Microsoft’s new Azure Kinect DK at Mobile World Congress today, and I’m surprised at how much smaller it is compared to the Kinect for Windows sensor. It’s also a lot lighter (440 grams vs. 970 grams) and more capable thanks to a range of upgraded hardware. There’s a 7-microphone array inside compared to the 4-microphone array in the previous Kinect, and an upgraded RGB camera capable of 3840 x 2160 images. The depth sensor is the same one found on the HoloLens 2, and it’s now capable of a range of resolutions and framerates.

Microsoft is planning to release a range of SDKs for this new Azure Kinect DK, and developers will need to port any existing Kinect for Windows apps over to this new platform as they won’t work directly with this new Kinect model. There’s a new sensor SDK, body tracking SDK, vision APIs, and speech service SDK for the Azure Kinect DK. Microsoft hasn’t published all of these SDKs just yet, but preorders for this $399 Kinect have already begun. It’s expected to ship in late June to developers.

Microsoft has a range of examples of how developers will use the Azure Kinect DK from retail to manufacturing and even healthcare. In retail stores, developers could use this new Kinect to track products and manage inventory, and given its body tracking support it could even potentially be used in cashier-less stores. Much like the original Kinect, the use cases will depend on how creative developers get with this latest model.

One thing this new Kinect sensor won’t do is replace Kinect for Xbox. It’s not designed to be used with an Xbox, but developers will be able to use it with or without Azure. I tried a brief demo of the body tracking capabilities of the new Kinect, measuring how high I could jump using the new SDKs that will be available once the device ships in late June. It reminded me a lot of the early Kinect demonstrations, but Microsoft now has a much smaller sensor and a clear aim for what the Kinect will be used for. It’s no longer a gaming peripheral, it’s a big part of the company’s “third era of computing” with HoloLens, and its big Azure cloud push.

I got a chance to get a closer look at Microsoft’s new Azure Kinect DK at Mobile World Congress today, and I’m surprised at how much smaller it is compared to the Kinect for Windows sensor. It’s also a lot lighter (440 grams vs. 970 grams) and more capable thanks to a range of upgraded hardware. There’s a 7-microphone array inside compared to the 4-microphone array in the previous Kinect, and an upgraded RGB camera capable of 3840 x 2160 images. The depth sensor is the same one found on the HoloLens 2, and it’s now capable of a range of resolutions and framerates.

Microsoft is planning to release a range of SDKs for this new Azure Kinect DK, and developers will need to port any existing Kinect for Windows apps over to this new platform as they won’t work directly with this new Kinect model. There’s a new sensor SDK, body tracking SDK, vision APIs, and speech service SDK for the Azure Kinect DK. Microsoft hasn’t published all of these SDKs just yet, but preorders for this $399 Kinect have already begun. It’s expected to ship in late June to developers.

Microsoft has a range of examples of how developers will use the Azure Kinect DK from retail to manufacturing and even healthcare. In retail stores, developers could use this new Kinect to track products and manage inventory, and given its body tracking support it could even potentially be used in cashier-less stores. Much like the original Kinect, the use cases will depend on how creative developers get with this latest model.

One thing this new Kinect sensor won’t do is replace Kinect for Xbox. It’s not designed to be used with an Xbox, but developers will be able to use it with or without Azure. I tried a brief demo of the body tracking capabilities of the new Kinect, measuring how high I could jump using the new SDKs that will be available once the device ships in late June. It reminded me a lot of the early Kinect demonstrations, but Microsoft now has a much smaller sensor and a clear aim for what the Kinect will be used for. It’s no longer a gaming peripheral, it’s a big part of the company’s “third era of computing” with HoloLens, and its big Azure cloud push.

Sunday 17 February 2019

Microsoft MCSA 70-347 Exam Dumps, 70-347 Question | RealExamDumps.com

Better Buy: Microsoft vs. Alphabet

Which of these tech giants is the best investment today?

Joe Tenebruso (TMFGuardian)

Feb 16, 2019 at 3:00PM

Microsoft (NASDAQ:MSFT) and Alphabet (NASDAQ:GOOGL) (NASDAQ:GOOG) are two of the most impressive businesses in the world today. These tech titans enjoy powerful competitive advantages that help them dominate massive global markets. In turn, they've seen their market value grow to a combined $1.6 trillion, creating vast wealth for their shareholders along the way.

But which is the better buy today? Let's find out.

Two rhinoceros with their horns pointing toward each other

WHO WILL COME OUT AHEAD IN THIS BATTLE OF BEHEMOTHS? IMAGE SOURCE: GETTY IMAGES.

Moat

With eight products -- Search, Android, Gmail, Chrome, Google Maps, Google Drive, Google Play Store, and YouTube -- that each boasts more than 1 billion monthly active users, Alphabet's scale and reach is unrivaled, other than perhaps by Facebook. The company's Google internet search engine lies at the core of Alphabet's empire, growing ever more intelligent and valuable with each new query conducted on its ubiquitous websites and mobile apps. Google's dominant ad platform generates copious amounts of cash, which Alphabet then uses to further expand its ecosystem of products and services. In this way, Alphabet has built a wide economic moat -- one that seemingly gets stronger every day.

Like Alphabet, Microsoft enjoys powerful competitive advantages in many of its key markets. The software giant dominates the business productivity segment with its Office franchise, and Windows is still the most popular operating software on personal computers worldwide. Yet Microsoft plays second fiddle to Amazon.com (NASDAQ:AMZN) in what is perhaps its most important market: cloud computing. To be sure, Microsoft's Azure cloud platform is growing at a torrid rate and has even been gaining share on Amazon in recent quarters. But unlike Google, whose market share routinely checks in at around 90% of the global internet search industry, Microsoft's share of the cloud infrastructure market currently checks in at less than 20%. While that leaves plenty of room for growth for Microsoft, it also points to a less competitively advantaged position than that of Google in search. For this reason, I'd argue that Alphabet has a wider moat.

Advantage: Alphabet

Financial strength

Let's now review some key financial metrics to see how Microsoft and Alphabet compare.

Revenue

DATA SOURCES: MORNINGSTAR, COMPANY FILINGS.

Both Alphabet and Microsoft are financial powerhouses, with each generating more than $45 billion in annual operating cash flow. Yet I was tempted to give Microsoft the edge here because of its superior free cash flow generation, which is due in part to its lower capital expenditure requirements compared to Alphabet. But after looking at their balance sheets, it's clear that Alphabet currently has the advantage in terms of financial fortitude. Though Microsoft has $18 billion more in cash reserves, it also has nearly $70 billion more debt. That places its net cash position at about $55 billion, compared to more than $105 billion for Alphabet. So while Microsoft's financial strength is impressive, Alphabet's is even more remarkable.

Advantage: Alphabet

Growth

Alphabet is also growing at a faster clip. Wall Street expects the search king's earnings to rise by more than 16% annually over the next five years, fueled by the continued growth of digital advertising. Microsoft's profits, meanwhile, are forecast to increase by 14% annually during this same time, driven by its cloud computing initiatives.

A 2-percentage-point difference in annual growth rates isn't much, but it's enough to give Alphabet the edge here.

Advantage: Alphabet

Valuation

Finally, let's take a look at some stock valuation metrics, including price-to-free-cash-flow (P/FCF), price-to-earnings (P/E), and enterprise value-to-EBITDA (EV/EBITDA) ratios.

P/FCF

Forward P/E

EV/EBITDA

DATA SOURCES: MORNINGSTAR, YAHOO! FINANCE.

All three metrics suggest the same thing: Microsoft's stock is the better bargain. Whether on the basis of free cash flow or earnings, Microsoft's shares are significantly less expensive than Alphabet's. This is true even when we account for Alphabet's larger net cash position, as we do by comparing their enterprise value-to-EBITDA ratios. Thus, Microsoft's stock is more attractively priced.

Advantage: Microsoft

The better buy is...

Microsoft and Alphabet are both elite enterprises that are well positioned to deliver market-beating gains to their shareholders in the coming years. But while Microsoft's stock may currently be cheaper, Alphabet's powerful competitive moat, superior balance sheet strength, and greater growth prospects make it the better long-term investment.

John Mackey, CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool's board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool's board of directors. Teresa Kersten, an employee of LinkedIn, a Microsoft subsidiary, is a member of The Motley Fool's board of directors. Randi Zuckerberg, a former Director of Market Development and Spokeswoman for Facebook and sister to CEO Mark Zuckerberg, is a member of The Motley Fool's board of directors. Joe Tenebruso has no position in any of the stocks mentioned. The Motley Fool owns shares of and recommends Alphabet (A shares), Alphabet (C shares), Amazon, and Facebook. The Motley Fool owns shares of Microsoft. The Motley Fool has a

Which of these tech giants is the best investment today?

Joe Tenebruso (TMFGuardian)

Feb 16, 2019 at 3:00PM

Microsoft (NASDAQ:MSFT) and Alphabet (NASDAQ:GOOGL) (NASDAQ:GOOG) are two of the most impressive businesses in the world today. These tech titans enjoy powerful competitive advantages that help them dominate massive global markets. In turn, they've seen their market value grow to a combined $1.6 trillion, creating vast wealth for their shareholders along the way.

But which is the better buy today? Let's find out.

Two rhinoceros with their horns pointing toward each other

WHO WILL COME OUT AHEAD IN THIS BATTLE OF BEHEMOTHS? IMAGE SOURCE: GETTY IMAGES.

Moat

With eight products -- Search, Android, Gmail, Chrome, Google Maps, Google Drive, Google Play Store, and YouTube -- that each boasts more than 1 billion monthly active users, Alphabet's scale and reach is unrivaled, other than perhaps by Facebook. The company's Google internet search engine lies at the core of Alphabet's empire, growing ever more intelligent and valuable with each new query conducted on its ubiquitous websites and mobile apps. Google's dominant ad platform generates copious amounts of cash, which Alphabet then uses to further expand its ecosystem of products and services. In this way, Alphabet has built a wide economic moat -- one that seemingly gets stronger every day.

Like Alphabet, Microsoft enjoys powerful competitive advantages in many of its key markets. The software giant dominates the business productivity segment with its Office franchise, and Windows is still the most popular operating software on personal computers worldwide. Yet Microsoft plays second fiddle to Amazon.com (NASDAQ:AMZN) in what is perhaps its most important market: cloud computing. To be sure, Microsoft's Azure cloud platform is growing at a torrid rate and has even been gaining share on Amazon in recent quarters. But unlike Google, whose market share routinely checks in at around 90% of the global internet search industry, Microsoft's share of the cloud infrastructure market currently checks in at less than 20%. While that leaves plenty of room for growth for Microsoft, it also points to a less competitively advantaged position than that of Google in search. For this reason, I'd argue that Alphabet has a wider moat.

Advantage: Alphabet

Financial strength

Let's now review some key financial metrics to see how Microsoft and Alphabet compare.

- Metric

- Microsoft

- Alphabet

Revenue

- $118.46 billion

- $129.87 billion

Operating cash flow

- $46.13 billion

- $45.25 billion

Free cash flow

- $31.90 billion

- $21.42 billion

Cash

- $127.66 billion

- $109.14 billion

Debt

- $73.17 billion

- $4.01 billion

DATA SOURCES: MORNINGSTAR, COMPANY FILINGS.

Both Alphabet and Microsoft are financial powerhouses, with each generating more than $45 billion in annual operating cash flow. Yet I was tempted to give Microsoft the edge here because of its superior free cash flow generation, which is due in part to its lower capital expenditure requirements compared to Alphabet. But after looking at their balance sheets, it's clear that Alphabet currently has the advantage in terms of financial fortitude. Though Microsoft has $18 billion more in cash reserves, it also has nearly $70 billion more debt. That places its net cash position at about $55 billion, compared to more than $105 billion for Alphabet. So while Microsoft's financial strength is impressive, Alphabet's is even more remarkable.

Advantage: Alphabet

Growth

Alphabet is also growing at a faster clip. Wall Street expects the search king's earnings to rise by more than 16% annually over the next five years, fueled by the continued growth of digital advertising. Microsoft's profits, meanwhile, are forecast to increase by 14% annually during this same time, driven by its cloud computing initiatives.

A 2-percentage-point difference in annual growth rates isn't much, but it's enough to give Alphabet the edge here.

Advantage: Alphabet

Valuation

Finally, let's take a look at some stock valuation metrics, including price-to-free-cash-flow (P/FCF), price-to-earnings (P/E), and enterprise value-to-EBITDA (EV/EBITDA) ratios.

- Metric

- Microsoft

- Alphabet (Class A Shares)

P/FCF

- 25.71

- 36.53

Forward P/E

- 21.38

- 24.02

EV/EBITDA

- 15.68

- 16.79

DATA SOURCES: MORNINGSTAR, YAHOO! FINANCE.

All three metrics suggest the same thing: Microsoft's stock is the better bargain. Whether on the basis of free cash flow or earnings, Microsoft's shares are significantly less expensive than Alphabet's. This is true even when we account for Alphabet's larger net cash position, as we do by comparing their enterprise value-to-EBITDA ratios. Thus, Microsoft's stock is more attractively priced.

Advantage: Microsoft

The better buy is...

Microsoft and Alphabet are both elite enterprises that are well positioned to deliver market-beating gains to their shareholders in the coming years. But while Microsoft's stock may currently be cheaper, Alphabet's powerful competitive moat, superior balance sheet strength, and greater growth prospects make it the better long-term investment.

John Mackey, CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool's board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool's board of directors. Teresa Kersten, an employee of LinkedIn, a Microsoft subsidiary, is a member of The Motley Fool's board of directors. Randi Zuckerberg, a former Director of Market Development and Spokeswoman for Facebook and sister to CEO Mark Zuckerberg, is a member of The Motley Fool's board of directors. Joe Tenebruso has no position in any of the stocks mentioned. The Motley Fool owns shares of and recommends Alphabet (A shares), Alphabet (C shares), Amazon, and Facebook. The Motley Fool owns shares of Microsoft. The Motley Fool has a

Monday 11 February 2019

70-347 - Microsoft Practice Exam Questions and Answers | Realexamdumps.com

Can Microsoft Be a Millionaire-Maker Stock?

The software giant looks like a good investment for the long haul.

Microsoft was founded on April 4, 1975, which means that it's almost 44 years old. In that time, it has certainly minted its fair share of millionaires. If you'd bought, say, $10,000 worth of its stock right around when it went public, you'd have roughly 100,000 shares worth about $10.5 million today.

Today, Microsoft isn't a small, scrappy company on its way to hitting it big -- it's a hugely successful behemoth that also happens to be one of the most valuable companies on the planet.

Microsoft logo.

IMAGE SOURCE: MICROSOFT.

The question you might be asking yourself today, then, is whether Microsoft can still be a "millionaire-maker" stock. The answer to that is "It depends!"

Let's dive more deeply into that.

What are you starting with?

Even though Microsoft is already large and successful, I think the odds are good that the company can -- as long as management continues the pattern of smart decision making that it's exhibited since CEO Satya Nadella took the reins -- continue to deliver value to shareholders in the form of meaningful capital appreciation as well as a growing dividend.

MSFT Dividend Chart

MSFT DIVIDEND DATA BY YCHARTS.

After all, the PC market that Microsoft is exposed to via its Windows operating system is showing signs of stabilizing. It's riding the cloud computing wave as one of the top providers of cloud computing services, and its Office family of products continues to enjoy sales growth, and the company is also a major player in the world of gaming. Microsoft plays in many great markets and has enviable positions in many of them.

With that being said, while Microsoft's stock has returned about 18.6% over the last year and more than 180% over the last five years, those rates of return are by no means guaranteed going forward, especially considering that Microsoft now needs to deliver growth from a market capitalization of about $810 billion rather than from roughly $300 billion.

So, whether Microsoft can be a "millionaire-maker" stock really depends on how much you're starting off with. If you put $10,000 into Microsoft today, is your investment likely to top $1 million within, for example, the next 20 years? Probably not. However, if you're starting with a significantly larger initial investment -- say, $500,000 or so -- then I think the odds are pretty good that you'll be able to at least double your money over the next 20 years by owning the stock and reinvesting the dividends, making you a millionaire.

Friday 1 February 2019

70-347 Microsoft Real Exam Questions-realexamdumps.com

Technology is advancing hence the need for experts and professionals. Becoming a professional or expert in a certain field requires you to have skills and knowledge. Through training and certifications, you learn a lot and attain skills that would be useful in your IT related career. Microsoft 70-347 exam is an exam administered to validate your ability to deal with client’s end user devices, SharePoint online, configuring online communication to enable online business and configure Office 365 services. Those who wish to take the exam should have knowledge of Skype, SharePoint, Office 365 Pro Plus and Microsoft Exchange Online. Passing this exam enables you to attain a Microsoft Certified Solutions Associate (MCSA) Office 365 certification

Friday 1 April 2016

Microsoft 70-347 Dumps Question Answer

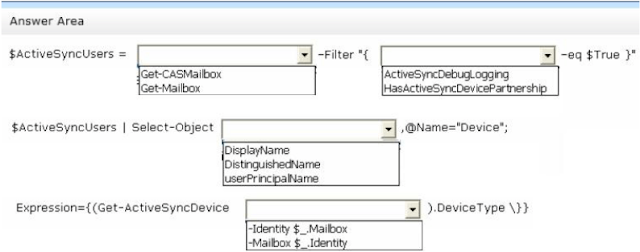

70-347 Question 9

You are the Office 365 administrator for your company. Management has requested a report of all Microsoft Exchange Active Sync-enabled employees and their devices. You need to generate a report that contains employee display names and device types.

How should you complete the relevant Windows Power Shell script? To answer, select the appropriate option from each list in the answer area.

Answer:

Thursday 31 March 2016

Microsoft 70-347 Exam Dumps

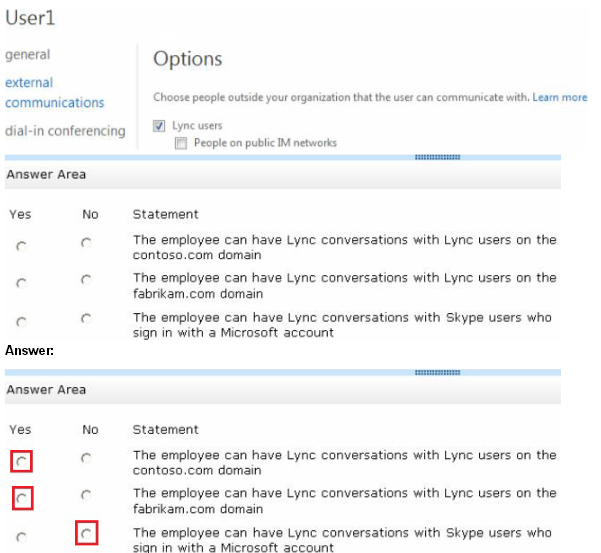

70-347 Question 8

Your company has an Office 365 subscription and uses Microsoft Lync Online.

The environment includes the domains shown in the following image, and is configured as shown in the exhibit.(Click the Exhibit button.)

Lync is not deployed in a hybrid configuration. An employee requires specific Lync communication settings. The employee's account is configured as shown in the following image.

For each of the following statements, select Yes if the statement is true. Otherwise, select No. Each correct selection is worth one point.

Subscribe to:

Posts (Atom)